My personal story is part of what drives me to help others manage their personal finances. Growing up I faced considerable uncertainty when it came to finances. I learned a lot from those experiences. I also became more educated through both my school and professional experiences. I feel fortunate to have overcome my past financial challenges. Confessions of a financial advisor discusses the challenges I faced growing up as well as what led me to focus on working with female-led households.

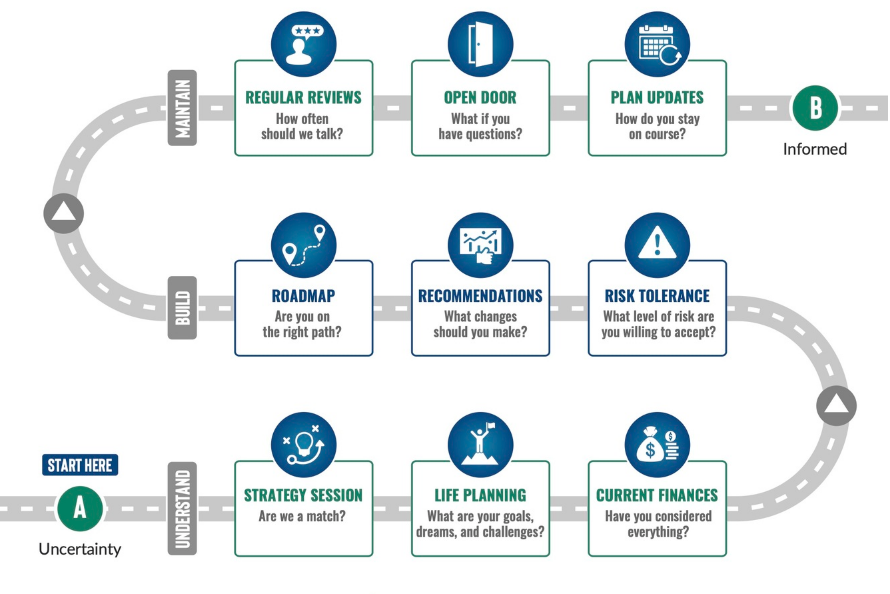

As a financial advisor, my goal is to help clients who are uncertain about their financial future become more informed. My process is designed to take clients on a path from Point A (Retirement Uncertainty) to Point B (an Informed Retirement). I encourage you to read my story below if you want more insight on why helping people successfully navigate financial planning is important to me.

Confessions of a Financial Advisor Part 1

Confessions of a Financial Advisor Video – Part 1

Role Models

There are two kinds of role models. The best ones set an example showing how you should do things. The bad ones do the exact opposite. When it comes to personal finances, I did not have good role models growing up. I learned much more about what not to do than what to do. If you can appreciate the difference, the bad role models may be more helpful than you could ever imagine. Sometimes seeing others around us do things the wrong way can motivate us to do better when our turn comes. Fortunately, it worked out that way for me.

My father was not a good role model when it came to personal finances. My mother knew better but didn’t have enough say to make a difference. This meant I grew up in a home dominated by poor credit, little savings, unpaid bills, and unmet promises. Retirement planning was an afterthought at best. With the benefit of hindsight, I could have been more aware of what was going around me and what it meant, but I allowed myself to be somewhat blind to it. On multiple occasions, we had things like our cable TV, electricity, or phone service turned off. After I was old enough to drive, I remember going to the electric company to pay an overdue bill so our power could be turned back on. (This is only one story. If we meet or talk, feel free to ask for others.)

We can only hide from reality for so long

After I decided where to go to college, the true effect of my father’s poor financial habits became much more personal.

As a financial advisor, I often talk to parents about the cost of college. We can get blinded by a school’s name brand. Yes, the type and quality of education you receive at one school relative to another can vary. In my experience, the biggest difference relates to how much material is taught during the semester. But if you make smart choices, you can overcome at least some of the differences between schools. I know this now. My wife and I have had many conversations about it with our kids – our third of four is finishing his college applications now.

When it was time for me to go to college, the cost was a lot less than it is today. But tuition still varied widely from one school to another. If my parents had a financial advisor when I was deciding where to go to college, my decision might have been much different.

What happened?

After realizing I was not going to be a professional athlete, I decided I wanted to be a doctor. I chose to go to Duke and major in Psychology. I believed graduating from Duke would give me the best chance of going to a good medical school. I had other quality college choices that would have cost much less. I ignored the cost because my father told me I could go anywhere I wanted. I fell in love with Duke when I visited the campus. I decided it was the place for me. My fascination with the school began when Duke made a surprising run at the national championship, losing in the finals to Kentucky. My freshman year was also Coach K’s first year at Duke. Believe it or not, things did not go that well in his early years. Many people wanted him fired after his third year. Personally, I was on the fence.

My decision to go to Duke didn’t work out the way I planned. I was always behind the eight-ball financially. I lived in fear of being told I would have to leave school because of unpaid tuition bills. Friends would go to the bursar’s office to ask questions for me because I feared I would be kicked out of school if I asked the questions myself. If I found a letter in my mailbox from the school, I cringed.

One year my father didn’t file for financial aid because he decided I wouldn’t qualify for it. As part of my effort to stay in school, I met with the President of the University. He had promised that nobody would be forced to leave the school because of some changes that were being made to student loan programs. Before he made that promise, I had made calls to the senators and congressmen from my home state of New Jersey as part of Duke’s unsuccessful lobbying effort to keep the changes from happening.

My meeting with Duke’s president helped. I was able to get financial aid (I lost some of it because my father’s failure to provide information meant I could no longer receive one form of aid for a recently concluded semester). This meeting allowed me to stay in school another year. After my junior year, I didn’t have the money to settle my outstanding balance. The school and I agreed I should take a leave of absence until my balance was paid. I only needed six more courses to graduate. I eventually repaid the balance, but I never returned.

What happened next?

After leaving Duke, I worked for Citibank. I also took a couple of courses at NYU (the bank paid for them). I had a vacation that December and went to Tucson to visit a couple of friends I’d made playing Strat-O-Matic baseball by mail. I have kept in touch with one of those friends ever since. A few years ago, my family and I spent a couple of days in Tucson visiting that friend. After I started my firm, he opened a small account. He has since added to it. He also transferred accounts for his two children to my management.

Back to my story. Two months after I took a vacation in Tucson, I decided to move there. If I was going to be out of school and working, I decided I might as well do it someplace different. That also allowed me to leave a home that made me unhappy. I drove across the country in a beat-up old car and moved to Tucson. I resigned from Citibank by mail. I wrote my resignation letter at the hotel I stayed in after the first day of my drive across the country. (Believe it or not, the bank president was very understanding. He sent me a nice letter in return and offered to give me a reference in the future.)

I lived in Tucson for about a year and a half before deciding it was time to go back to school. The idea of medical school was out the window. (My grades at Duke were okay but not as good as they should have been. The financial stress wore on me.) I knew I’d have to go to graduate school if I got my psychology degree. That was a cost I could not bear. I decided to pursue an accounting degree. Duke does not offer accounting degrees – the school believes you should get a liberal arts education and go to business school afterward. I applied to the University of Arizona and Rutgers. I had dual residency (NJ from my parents). I decided I’d get a better job if I returned home, so I went to Rutgers.

This completes the first part of my “confession.” If you would like help planning to pay for college for your children or becoming more informed about your retirement, please use this link to schedule a free Strategy Session.

Confessions of a Financial Advisor PART 2

Confessions of a Financial Advisor Video – Part 2

It Can Happen to Anyone

Even financial professionals can have times in their lives when they don’t make all the right financial decisions. Sometimes you have little choice but to incur debt to advance your career. Even if you choose with costs in mind, college can still be expensive. Not all parents help their kids pay for college. I know my father certainly didn’t deliver on what he promised. Looking back, I think my mother tried to warn me, but I made my decision without really understanding the consequences.

If you make a poor decision, hopefully, you realize what went wrong before it’s too late. Once you do, it’s important to put a plan in place to fix the problem. Then you need the discipline to stick to it. Working with a financial advisor can help you avoid these issues before they become problems. When I speak to prospects, I often refer to the “knowing-doing” gap. In other words, we often know what to do, but we don’t do it on our own. It’s nice to have somebody looking over your shoulder to make sure you stay on track.

A Change of Schools and a First Job

At Rutgers, I worked part-time during the school year and full-time over the summer and earned my accounting degree. I paid tuition and rent with credit card checks when I was short of funds. I thought little of running up credit card debt. I didn’t think much about the consequences. I was managing a lot of financial uncertainty. Using my credit cards to make ends meet was the only way I could continue to achieve my goals. I knew I would pay enough each month to stay out of trouble. I had to pay for tuition, food, and rent. Writing those checks when funds were low was the only way I could stay on the course I set for myself.

I graduated from Rutgers and got a job with Deloitte Haskins & Sells (Deloitte later merged with Touche Ross). At the end of my first year at Deloitte, I was horrified when I realized how much I had paid in credit card interest. I formulated a plan to repay every cent. A little bit of professional good fortune allowed me to do so in advance of my target date. I haven’t paid meaningful amounts of credit card interest since. I worked for Deloitte for more than six years.

Allow me to move the story forward a little bit before I get back to the main timeline. The company I worked for after leaving Deloitte was taken over. I used the severance pay I received when I found another job to repay my student loan balances and buy an engagement ring for my wonderful wife Diana. (We were married 25 years this past June.) After all I’d been through financially, it felt good to know that my wife and I would start our life together with no debt other than our respective mortgages. (We sold one of our homes shortly after we got married.)

Returning Home

After graduating from Rutgers, I moved back home. One day I arrived home early and got the mail. There were credit card bills with my name on them, but they weren’t mine. With some digging, I discovered my father forged my name to open those accounts– he had no other way to get credit. When I moved back in, my father made me pay rent. After I found out what happened, I directed those payments to repay the credit card balances. Because of the payment history, the card companies let the accounts stay open even though I told them what happened. That ultimately created more issues for my parents.

The Diagnosis

Three years after I graduated from college, my mother was diagnosed with Stage 4 breast cancer. She was only 51! I remember the day very well. The same night as her surgery Duke played UNLV for the national championship. I had been looking forward to the game. After my mother’s diagnosis, I was hoping we would win, providing at least a small ray of light on such a depressing day. No chance. The game was never close. We lost by 30. At least we got our revenge the next year when we beat an undefeated UNLV in the Final Four. We won our first national championship that year, too.

After my mother’s diagnosis, the full truth about my parent’s financial situation came to light. My father had refinanced the house several times. I believe he owed more than he originally paid. The interest rate was well above what most people paid at the time. The credit card accounts opened with the forged signatures were all overdue. My parents were in bad shape financially.

My mother, much to my father’s chagrin, asked me to manage their finances. I agreed. I still remember going to the bank with my mother to open a new account. That way I could have the authority to sign checks and manage the payment of their bills. I also reconciled, reviewed, and arranged the corresponding payments related to the explanation of benefits statements we received detailing the costs of my mother’s treatment. I could also make sure the other bills were paid on time. It wasn’t a comfortable situation, but I had to do it. While I couldn’t get my parents out of their financial hole, I was able to make things more manageable. Bills were paid on time. None of my mother’s care providers called or sent threatening letters because they were not being paid.

My parents had to sell the house my sister and I spent most of our childhoods in. They rented a small condo about 30 minutes away.

This completes the second part of my “confession.” If you would like help with your finances, please use this link to schedule a free Strategy Session.

Confessions of a Financial Advisor – FINAL EPISODE

Confessions of a Financial Advisor Video – Part 3

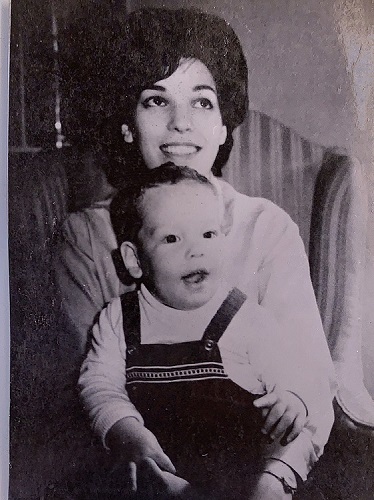

My Parents

My mother went to junior college and got married at a young age. Once my younger sister and I were in school, she held several different jobs. She decided she wanted more. When she was in her 40s, she returned to school. She graduated and became an occupational therapist. She worked in hospitals and rehab facilities for a few years. She got tired of working for others and decided to start a business of her own. Her business was just starting to be successful when she was diagnosed.

My father was a commission salesman. He received a weekly draw, but he didn’t earn a regular salary. I’m sure that added to his difficulties with managing money. He wasn’t good at budgeting either.

I know in my heart my mother’s decisions to return to school and start her own business were likely driven by a desire to be able to survive on her own. Sadly, she died about 18 months after her original diagnosis. She was only 53. Her post-menopausal cancer behaved more like it was pre-menopausal. Her cancer metastasized to her brain. Not long after, my father did a couple of other things that ultimately caused my sister and I to stop speaking to him. I tried writing a couple of letters to explain how we got to that point. (In addition to the financial issues, my father was verbally abusive.) It was clear my father didn’t understand what I felt.

My father is still alive. Periodically, he sent my sister and me letters over the years. Shortly before COVID hit, he sent a letter that struck a chord. I decided to meet him face-to-face for the first time in more than 25 years. It was also the first time my wife and kids ever met him. We have exchanged daily emails ever since. I was a bit hesitant initially, but I’m glad we are back in touch. I’m hoping to see him again over the Thanksgiving holiday.

Why Is This Relevant?

There are parts of me that wish I made different choices. But I know I would not have met my wonderful wife if I had pursued the original path. She and I wouldn’t have our four great kids. Without their love and support, I would not be in the position I am today. There are tradeoffs. It’s hard to realize this sometimes, but they were worth it.

I have experienced several financial hardships over the years. I was fortunate to receive an education and have the discipline to fix things. I appreciate the opportunity to work with others and help them avoid the mistakes that happened around me as I was growing up. I also know my parents were not prepared for retirement. With the knowledge and experience I’ve gained, I know I can help others overcome their financial uncertainty and become more informed about their retirement.

Recently, a good friend suggested that I focus on getting more female clients. I asked her why she felt that way. Her answer was both insightful and helpful. It also got me started thinking more about who my clients are. I realized that roughly two-thirds fit the following description: single or divorced women or families where the wife works and is the primary point of contact and/or takes the lead on financial matters. I had not realized this until my friend brought it up. I believe the story I have shared makes it a lot easier to understand.

I was lucky. I was able to secure an education and figure things out on my own. Many people can’t. Our system doesn’t provide financial education. Seeing what my mother went through has made me want to do what I can to help others, especially professional women, gain greater control and certainty over their financial lives.

I also enjoy explaining things. I like taking complex ideas and concepts and making them more understandable. I am also an educator. I got my first taste of educating others about financial concepts when I wrote for The Motley Fool. I learned that building a base of knowledge allows you to explain more complex topics as well. I also discovered that if you want to explain things to others you must have a deep understanding of them. You must be willing to say, “I don’t know” when you don’t know the answer. But an advisor can’t stop there. He or she must take the time to learn the answer. Then you must be able to explain it in understandable terms.

SUMMARY

I know firsthand the impact failing to save and prepare for your financial future can have. It meaningfully impacted my personal and professional life. I know this was particularly hard on my mother who had little control over the finances in our home. I want to help others, especially professional women, avoid the situations I encountered growing up.

I also can’t begin to tell you how important my family is to me. They sacrificed a lot to allow me to launch a business at this stage of life – our four kids are ages 23, 20, 18, and 14. I launched a business from zero and am growing it. If I hadn’t repaid my debts, and my wife and I hadn’t saved and invested since we got married, I would not have been able to start my business. While I have always worked in a finance-related field, I have changed the focus of my work several times. While one can argue that we make our own luck, I still feel extremely lucky that everything worked out the way it has. My relationship with my wife helped me change my perspective. I am much more optimistic now.

As noted above, my wife and I celebrated our 25th anniversary earlier this year. I think that helps me make me a better financial planner. There is more to a financial plan than knowing what you own (assets), what you owe (liabilities), what you earn (income), and what you spend (expenses). It must take into account your goals, your dreams, and your tolerance for risk, too. That’s why I start my financial planning process with a series of life planning questions. It helps me – and my clients – better understand what is truly important to them. It helps them prioritize what matters most versus what would be nice to have.

I also love the work I do. I appreciate the confidence clients have in me. I enjoy helping others envision and work toward a future that will allow them to maintain their quality of life in their working years as well as in retirement.

Thank you for listening to my story. Just like many of you, I have experienced financial hardship during my life. Fortunately, I have been able to overcome these hardships. If you think I can help you manage your financial life and move from retirement uncertainty to being more informed about retirement, please use this link to schedule a free Strategy Session.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/