Investment Management

Apprise provides wealth management services on a fee-only basis. Client portfolios are managed according to the client’s stated investment goals and objectives. Portfolios are tailored to the needs of the individual client.

We work closely with the client to draft an investment policy statement (IPS) which sets the parameters for the investment portfolio. Among other factors, the statement incorporates investment return expectations, risk tolerance, time horizon, liquidity needs, and income requirements in formulating an asset allocation and asset location framework.

Our Approach

We employ a value-oriented investment style holding a combination of growth and value stocks, exchange-traded funds, and mutual funds. Value stocks typically trade at low prices relative to anticipated earnings and have above-average dividend yields. Growth stocks offer value when purchased at prices that do not reflect future growth potential. Our goal is not necessarily to beat the market but to build a portfolio that allows clients to meet their short- and long-term goals and objectives.

Why Choose Us

INTEGRATED APPROACH

Our approach to wealth management helps clients align their capital with what matters most to them.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

ACCOUNTABILITY

As fiduciaries, we give you guidance you can trust, and we care about your financial life. We provide advice that uses simple language to explain complex topics, helping to foster financial literacy.

Our feeling is that the quality of our advice is based on the depth of the relationships we build with each client. We are committed to helping you meet your financial goals.

PEACE OF MIND

We do our best to avoid elevating stress levels. Therefore, you will never see a market barometer or breaking news on this site – that is simply more noise.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

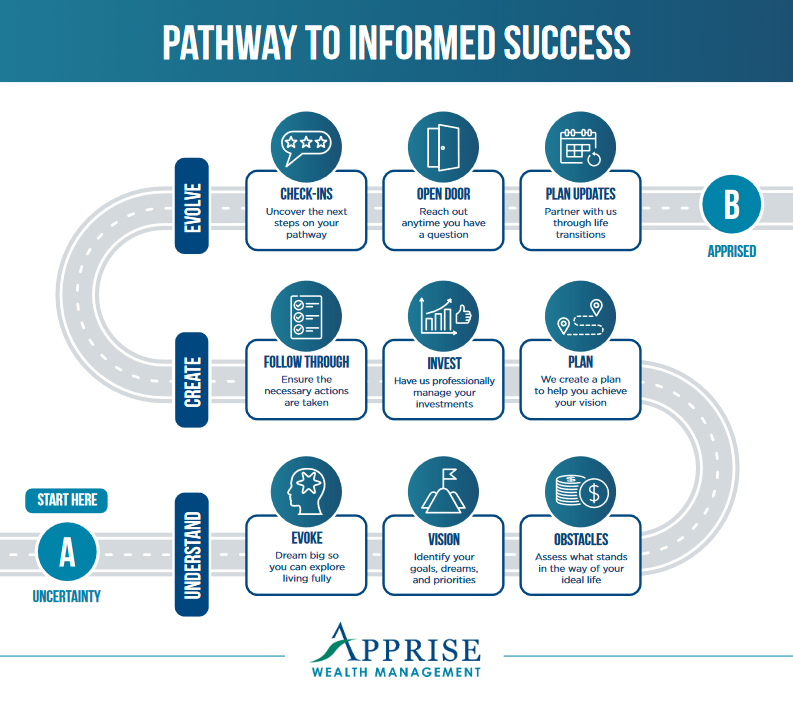

Pathway to Informed Success